Demand for multifamily assets remain strong even during this ongoing pandemic. Check out the following excerpt and data from Marcus and Millichap’s August Research Brief for Q2 demand (full report here):

“Multifamily leasing resumes in force. Ongoing employment growth and the resumption of many normal routines bolstered household formation in the spring and summer, leading to a record number of apartments being absorbed in the second quarter. The rapid acceleration of housing demand dropped the vacancy rate 90 basis points year over year to 3.8 percent, just above the two-decade low posted in 2019. Fundamentals are expected to stay strong going forward even as eviction moratoriums phase out in the coming months. The rising cost of homeownership, paired with the return of many employees and students to offices and campuses, will bolster already-high renter demand. Apartments near colleges may be particularly hard to come by, as numerous students have already secured housing for the fall.”

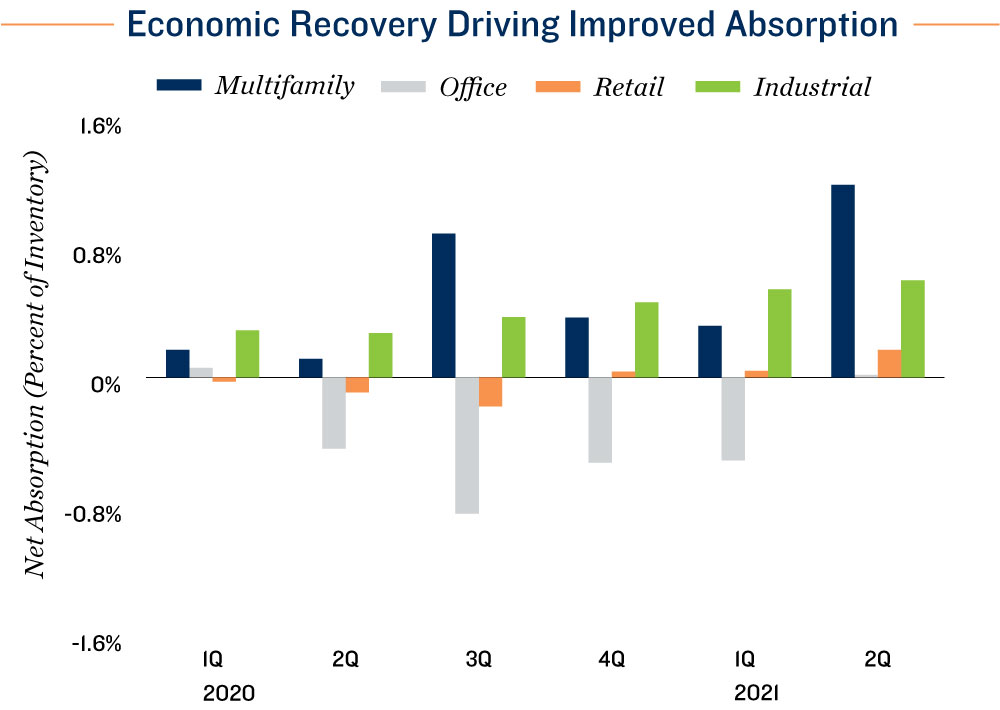

Absorption Data

Check out the data below. Whereas office experienced negative absorption in the past year, retail’s absorption was modest at best. Industrial had the second highest absorption rates to multifamily real state which had the highest absorption overall since the pandemic hit in Q1 of 2020. In fact, according to Marcus and Millichap the multifamily sector registered its largest quarterly absorption total since at least 1993!

What is Absorption?

Absorption is a popular metric used in commercial real estate to measure demand. Net absorption measures the number of units being leased net of those no longer being leased. A positive rate of absorption means that more units are overall leased compared to last quarter. Negative absorption means that less overall are leased than the previous.

Positive absorption demonstrates demand for the asset class and an ongoing trend of increased absorption rates demonstrates growing demand which is a favorable sign for those invested in the asset class.

Multifamily Outlook

Multifamily real estate is still in strong demand. This is further supported by the nationwide shortage of units to meet that demand.

For those who desire to better understand this asset class, put simply, people will always need a place to live. We need enough housing for those people. Investing in areas of population growth, job growth and diversity is one low-risk strategy to participating in the ongoing demand for multifamily housing.

Sign Up For Our Newsletter 👇🏾

Subscribe to My Channel 👇🏾

💡Invest Your Retirement w/ eQRP

– I Rolled My 401k Into eQRP to Passively Invest In Apartments